2025 FAFSA Simplification: Maximize Aid Eligibility Now

The 2025 FAFSA Simplification introduces significant changes to financial aid calculations and application processes, requiring proactive understanding of new deadlines and eligibility criteria to maximize student support.

For many aspiring students and their families across the United States, Understanding the 2025 FAFSA Simplification: Key Changes and Deadlines to Maximize Financial Aid Eligibility Within the Next 3 Months is not just important; it’s absolutely crucial. This overhaul represents the most significant transformation in federal student aid in decades, promising a streamlined experience but also introducing new complexities that demand attention. Are you prepared for what’s coming and how it will impact your college funding?

Navigating the New FAFSA Landscape

The Free Application for Federal Student Aid (FAFSA) is undergoing a monumental transformation for the 2025-2026 award year. This simplification aims to make the application process easier for students and families, expand eligibility for federal student aid, and provide a more accurate assessment of financial need. However, simplification does not always mean straightforward, and understanding the nuances of these changes is paramount for maximizing aid eligibility.

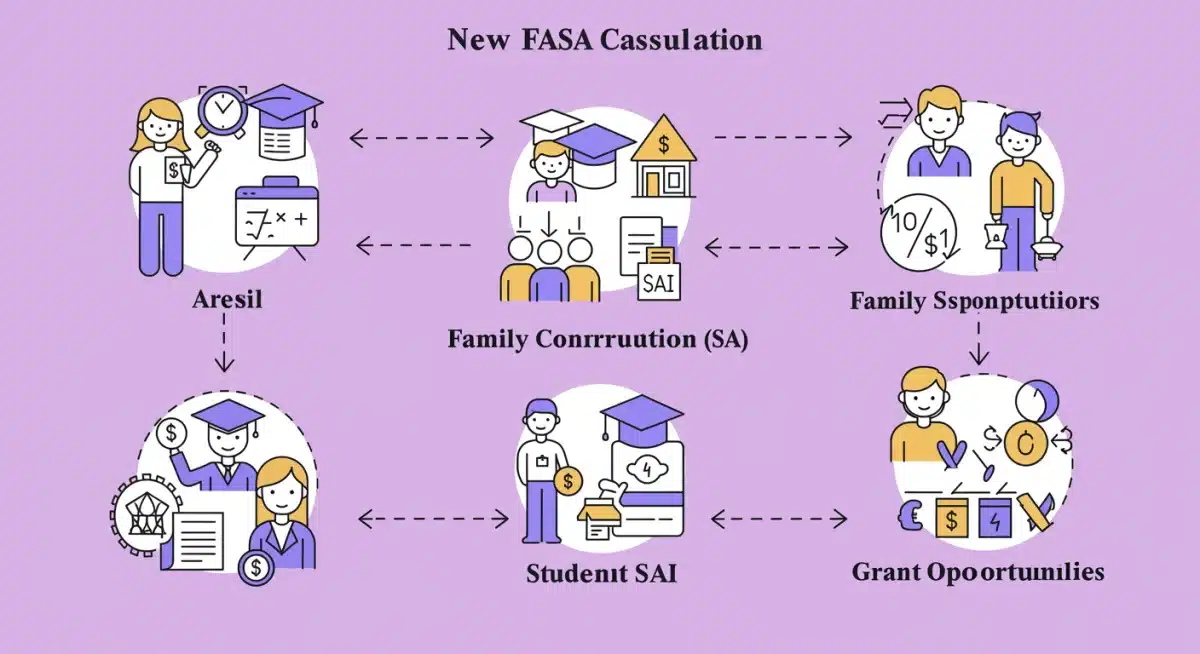

Changes include a redesigned form, a new methodology for determining aid, and revised terminology. Gone are the days of the Expected Family Contribution (EFC); it’s replaced by the Student Aid Index (SAI). This shift is more than just a name change; it fundamentally alters how a student’s financial need is calculated, potentially impacting the amount of aid they receive. Families must familiarize themselves with these new concepts to accurately prepare and submit their applications.

Understanding the Student Aid Index (SAI)

The Student Aid Index (SAI) is a new eligibility metric that replaces the Expected Family Contribution (EFC). The SAI can be a negative number, down to a minimum of -1,500, which can increase eligibility for Pell Grants and other needs-based aid for the lowest-income students. This change is designed to better identify students with the greatest financial need. It’s a significant departure from the EFC, which could only be zero at its lowest.

- Negative SAI Potential: Allows for greater recognition of financial hardship.

- Income Protection Allowances: Increased to shield more of a family’s income from the aid calculation.

- Asset Reporting: Changes to how certain assets are considered, potentially benefiting some families.

The move to the SAI is a central pillar of the FAFSA Simplification Act, intended to create a more equitable system. It is vital for applicants to understand how their specific financial situation will be assessed under this new index. While the goal is simplification, the initial learning curve can be steep, requiring diligent research and attention to detail from applicants.

Ultimately, navigating the new FAFSA landscape successfully means staying informed about every component of the simplification. Proactive engagement with the updated requirements and resources will be critical for students to secure the financial assistance they need for their educational journeys.

Key Changes to FAFSA Application Process

The 2025 FAFSA application process introduces several significant changes designed to streamline the experience and improve accessibility. These modifications extend beyond just terminology, impacting how information is collected, who needs to contribute, and how aid is disbursed. Understanding these procedural shifts is crucial for a smooth application.

One of the most notable changes is the expanded use of direct data exchange with the IRS. This means that applicants and contributors (parents or spouses) will grant permission for their tax information to be directly transferred to the FAFSA form, significantly reducing manual entry and potential errors. This feature aims to simplify the process, but it also underscores the importance of timely tax filing.

Contributor Definition and Requirements

The FAFSA Simplification Act redefines who must provide financial information on the application. A ‘contributor’ is anyone required to provide their information on the FAFSA, which can include the student, their parents, or their spouse. This is particularly relevant for dependent students, where parental information is mandatory. The number of contributors directly impacts the complexity of the application.

- Parental Information: Required from the parent who provides the most financial support, regardless of who the student lives with.

- IRS Direct Data Exchange: All contributors must consent to the direct transfer of tax data from the IRS.

- Spousal Information: Required for married students or parents, as applicable, also subject to direct data exchange.

Failure to provide consent for the IRS direct data exchange from all required contributors will result in an incomplete FAFSA application, blocking the student from receiving federal financial aid. This makes communication and cooperation among family members more important than ever. The system is designed to catch discrepancies, so accuracy and full disclosure are paramount.

Another procedural change involves the FAFSA Submission Summary, which replaces the Student Aid Report (SAR). This document will provide students with a summary of their application data and their Student Aid Index (SAI), along with an estimate of their federal Pell Grant eligibility. This improved summary aims to be more user-friendly and informative, helping students understand their aid potential.

In essence, the new FAFSA application process emphasizes digital integration and a clearer definition of financial responsibility. Students and their families should prepare by gathering necessary documents and understanding the roles of all contributors well in advance of the application opening.

Critical Deadlines and Timeline for 2025 FAFSA

Meeting deadlines is always critical for financial aid, and the 2025 FAFSA Simplification brings some adjustments to the typical timeline. While the official opening date for the 2025-2026 FAFSA is expected to revert to October 1, 2024, it’s essential for students and families to monitor official announcements closely, as initial implementation might cause slight variations. However, the general advice remains: apply as early as possible.

Federal, state, and institutional deadlines all play a role in determining aid eligibility. Federal deadlines are the last possible dates to submit your FAFSA for federal aid, while state and college deadlines are often much earlier. Missing a state or college deadline could mean missing out on significant aid opportunities, even if you still qualify for federal aid.

Three-Month Action Plan

With the application period approaching, a proactive three-month action plan can significantly improve your chances of maximizing financial aid. This plan should focus on preparation, information gathering, and timely submission.

- Month 1: Research and Gather Documents: Understand the new FAFSA form and required documentation. Collect tax records (W-2s, 1099s, tax returns) for all contributors, bank statements, and investment records. Create an FSA ID for both the student and all contributors if they don’t already have one.

- Month 2: Review and Understand Changes: Dive deeper into the specifics of the Student Aid Index (SAI) and how it might impact your eligibility. Utilize online resources, college financial aid offices, and webinars to clarify any uncertainties. Start discussions with all required contributors to ensure they understand their role and consent requirements.

- Month 3: Prepare for Submission: As the FAFSA opening date approaches, ensure all contributors have their FSA IDs and are ready to provide consent for direct data exchange. Double-check all gathered information for accuracy. Plan to submit the FAFSA as soon as it opens to meet priority deadlines for state and institutional aid.

Many states and colleges operate on a first-come, first-served basis for certain aid programs. Therefore, submitting your FAFSA shortly after it opens is often the best strategy to secure the maximum possible aid. Delays can lead to reduced aid packages or missed opportunities entirely. Staying organized and adhering to this timeline will be crucial.

Ultimately, the critical deadlines for the 2025 FAFSA are not just about the federal cut-off. They encompass a broader timeline that includes state and institutional priority dates, all of which require careful planning and prompt action from applicants and their families. Proactive engagement will truly make a difference.

Impact on Pell Grant Eligibility

The 2025 FAFSA Simplification is expected to have a profound impact on Pell Grant eligibility, primarily by expanding access to this vital federal grant for more students. The changes are designed to simplify the criteria and ensure that federal aid reaches those who need it most, particularly students from low-income backgrounds. This is one of the most celebrated aspects of the FAFSA overhaul.

A major factor in this expanded eligibility is the introduction of the Student Aid Index (SAI) replacing the EFC. As mentioned, the SAI can be a negative number, allowing for a more nuanced understanding of a family’s financial need. This means that students with extremely limited financial resources are more likely to qualify for the maximum Pell Grant award.

Automatic Maximum and Minimum Pell Grants

Under the new system, certain applicants will automatically qualify for a maximum Pell Grant, while others will be eligible for a minimum Pell Grant, based on specific income thresholds and family size. This streamlines the determination process and provides greater predictability for eligible students.

- Maximum Pell Grant: Students whose families meet specific poverty guidelines based on family size and adjusted gross income (AGI) will be automatically eligible for the maximum Pell Grant.

- Minimum Pell Grant: Students whose families meet slightly higher income thresholds will be eligible for a minimum Pell Grant, broadening the reach of this aid.

- Simplified Calculations: For many, the Pell Grant eligibility will be determined more directly from their income and family size, reducing complex calculations.

Furthermore, the FAFSA Simplification Act restores Pell Grant eligibility for incarcerated students enrolled in approved postsecondary programs and clarifies eligibility for students who have experienced unique circumstances, such as being a victim of human trafficking or having a parent who died in the line of duty as a public safety officer. These provisions aim to remove barriers to education for vulnerable populations.

The changes also simplify the calculation of Pell Grant eligibility for students whose parents are divorced or separated, using the parent who provides the most financial support rather than the parent the student lived with most. This aligns with the overall goal of making the application more intuitive and fair.

In conclusion, the 2025 FAFSA Simplification is poised to significantly enhance Pell Grant accessibility and amounts for a wider range of students. Understanding these new eligibility criteria is essential for students hoping to leverage this crucial federal funding source for their higher education.

Strategies to Maximize Your Financial Aid

Maximizing financial aid eligibility under the 2025 FAFSA Simplification requires a strategic approach. Beyond simply submitting the form on time, specific actions can significantly impact the amount of aid you receive. These strategies involve careful financial planning, understanding the new calculation methods, and proactive engagement with financial aid resources.

One primary strategy is to understand how your assets and income are now viewed under the Student Aid Index (SAI). While the FAFSA has always considered these factors, the new methodology may treat certain assets differently. For instance, the value of a small family business (with fewer than 100 employees) and family farms will no longer be excluded from asset calculations, which is a significant change for some families.

Optimizing Your Financial Profile

Before applying, consider how you can optimize your financial profile to present the most favorable picture possible for aid eligibility. This doesn’t mean hiding assets, but rather understanding how different types of assets and income are weighted and planning accordingly.

- Minimize Savings in Student’s Name: Funds held in a dependent student’s name are assessed at a higher rate than those held in a parent’s name. If possible, shift savings to a parent’s account before the base tax year.

- Understand Investment Impact: Non-retirement investment accounts are considered assets. If you have significant liquid investments, consult with a financial advisor about strategies to manage them in a way that minimizes their impact on your SAI.

- Income Timing: If possible, plan for major income events (like bonuses or asset sales) to occur in a year that won’t be used as the base tax year for FAFSA calculations.

Another crucial strategy is to complete the FAFSA using accurate and complete information. Any errors or omissions can delay processing or lead to a lower aid offer. Take your time, double-check every entry, and ensure all required contributors have provided their information and consent for direct data exchange. The new system is designed to be more efficient, but it relies heavily on accurate initial input.

Furthermore, don’t overlook state and institutional aid. Many colleges have their own financial aid forms (like the CSS Profile) and specific scholarship opportunities. Researching and applying for these additional aid sources can significantly supplement federal aid. Engaging directly with college financial aid offices can also provide valuable insights and guidance tailored to your specific situation.

In summary, maximizing financial aid involves a combination of early preparation, a deep understanding of the new FAFSA rules, and strategic financial planning. By taking these steps, students and families can significantly improve their chances of securing the financial support needed for higher education.

Common Pitfalls and How to Avoid Them

Despite the FAFSA Simplification Act’s goal of making the application process easier, several common pitfalls can still hinder a student’s ability to maximize their financial aid. Being aware of these potential issues and taking steps to avoid them is just as important as understanding the new rules. Proactive problem-solving can save significant time and stress.

One of the most frequent mistakes is waiting until the last minute to complete the FAFSA. While federal deadlines are typically later, many states and colleges have priority deadlines that, if missed, can result in losing out on limited aid funds. Submitting the FAFSA as soon as it opens ensures you’re considered for the widest array of aid programs.

Avoiding FAFSA Application Errors

Errors on the FAFSA form itself are another common pitfall. Even with the IRS direct data exchange, some information still needs to be manually entered, and mistakes can happen. These errors can range from incorrect social security numbers to misreported asset values, all of which can lead to delays or incorrect aid calculations.

- Incorrect FSA ID: Ensure both the student and all contributors have correctly created and linked their FSA IDs.

- Non-Consent for IRS Data Retrieval: All contributors must provide consent for their tax information to be transferred directly from the IRS. Failing to do so will invalidate the FAFSA.

- Reporting Untaxed Income Incorrectly: Be diligent in reporting all untaxed income, such as child support received, housing allowances, or veteran’s non-education benefits, as these impact the SAI.

Another pitfall is not understanding the new definition of a ‘contributor’ and failing to include all necessary parties on the FAFSA. For dependent students, this typically means both legal parents, unless specific circumstances apply. If a student’s parents are divorced or separated, the parent who provides the most financial support must complete the FAFSA, along with their spouse if remarried. Misidentifying the contributor can lead to an incomplete application and significant delays.

Finally, overlooking the importance of the FAFSA Submission Summary (the replacement for the SAR) can be a mistake. This document provides critical information about your SAI and Pell Grant eligibility. Reviewing it carefully for any inaccuracies and understanding its implications is vital for ensuring your aid package is correct.

By being meticulous, planning ahead, and thoroughly understanding the new requirements, students and families can successfully navigate the 2025 FAFSA process and avoid common pitfalls, ultimately securing the maximum possible financial aid.

Additional Resources and Support

Navigating the complexities of the 2025 FAFSA Simplification doesn’t have to be a solitary journey. A wealth of resources and support systems are available to help students and families understand the changes, complete the application accurately, and maximize their financial aid eligibility. Knowing where to turn for reliable information can make a significant difference.

The primary source for official and up-to-date information is the Federal Student Aid (FSA) website, studentaid.gov. This site offers comprehensive guides, FAQs, and direct access to the FAFSA application itself. It’s continuously updated with the latest information regarding the simplification and any procedural adjustments.

Where to Find Expert Guidance

Beyond federal resources, numerous organizations and educational institutions offer specialized assistance. These can be particularly helpful for personalized advice or for addressing unique family circumstances.

- College Financial Aid Offices: These professionals are experts in federal, state, and institutional aid. They can provide guidance specific to your chosen institutions and help interpret your aid offers.

- High School Counselors: Many high school guidance counselors are well-versed in the FAFSA process and can offer support for current students.

- Non-Profit Organizations: Various non-profit groups focus on college access and financial aid, offering free workshops, one-on-one counseling, and online resources. Examples include NCAN (National College Attainment Network) and local college access programs.

Additionally, virtual webinars and online tutorials are becoming increasingly popular ways to learn about the FAFSA changes. Many educational institutions and financial aid experts host these sessions, often providing opportunities for live Q&A. Subscribing to newsletters from trusted financial aid sources can also keep you informed about critical updates and deadlines.

Don’t hesitate to utilize the FAFSA Help Center, which can be accessed through studentaid.gov. This resource provides contact information for phone support, email assistance, and live chat options, allowing you to directly address specific questions or technical issues you might encounter during the application process.

In conclusion, while the 2025 FAFSA Simplification introduces new challenges, ample resources are available to guide students and families through the process. Proactive engagement with these support systems will empower applicants to confidently complete their FAFSA and secure the financial aid they deserve for their educational pursuits.

| Key Change | Brief Description |

|---|---|

| EFC Replaced by SAI | Expected Family Contribution (EFC) is now the Student Aid Index (SAI), which can be a negative number. |

| IRS Direct Data Exchange | Mandatory consent for direct tax data transfer from IRS, reducing manual entry. |

| Contributor Definition | Redefined who must provide financial information, impacting divorced/separated parents. |

| Expanded Pell Grant Eligibility | New criteria allow more students, especially low-income, to qualify for maximum Pell Grants. |

Frequently Asked Questions About 2025 FAFSA Simplification

▼

The most significant change is the replacement of the Expected Family Contribution (EFC) with the Student Aid Index (SAI). The SAI offers a new methodology for determining financial need, which can now be a negative number, potentially increasing Pell Grant eligibility for many students.

▼

While the federal FAFSA typically opens October 1st, it is crucial to submit it as early as possible. Many state and institutional aid programs operate on a first-come, first-served basis, meaning early submission increases your chances of receiving more aid.

▼

A ‘contributor’ is anyone required to provide financial information on the FAFSA. This includes the student, and for dependent students, the parent who provides the most financial support (and their spouse if remarried). All contributors must provide consent for IRS data retrieval.

▼

The simplification expands Pell Grant eligibility, especially for low-income students, through the new SAI calculation. Some students will automatically qualify for maximum or minimum Pell Grants based on income and family size, making aid more accessible.

▼

Errors can delay processing or reduce aid. It’s vital to double-check all information before submission. If an error is found after submission, you can usually correct it online via the FAFSA website once your application has been processed.

Conclusion

The 2025 FAFSA Simplification marks a pivotal moment in federal student aid, promising a more equitable and streamlined process for millions of students. While the changes aim to simplify the application and expand eligibility for critical aid like the Pell Grant, proactive engagement and thorough understanding of the new Student Aid Index (SAI), contributor definitions, and critical deadlines are essential. By preparing diligently, leveraging available resources, and avoiding common pitfalls, students and families can confidently navigate this new landscape and maximize their financial aid eligibility, ensuring higher education remains an accessible dream.