Navigating 5.5% Inflation: Investment Strategies for US Savers

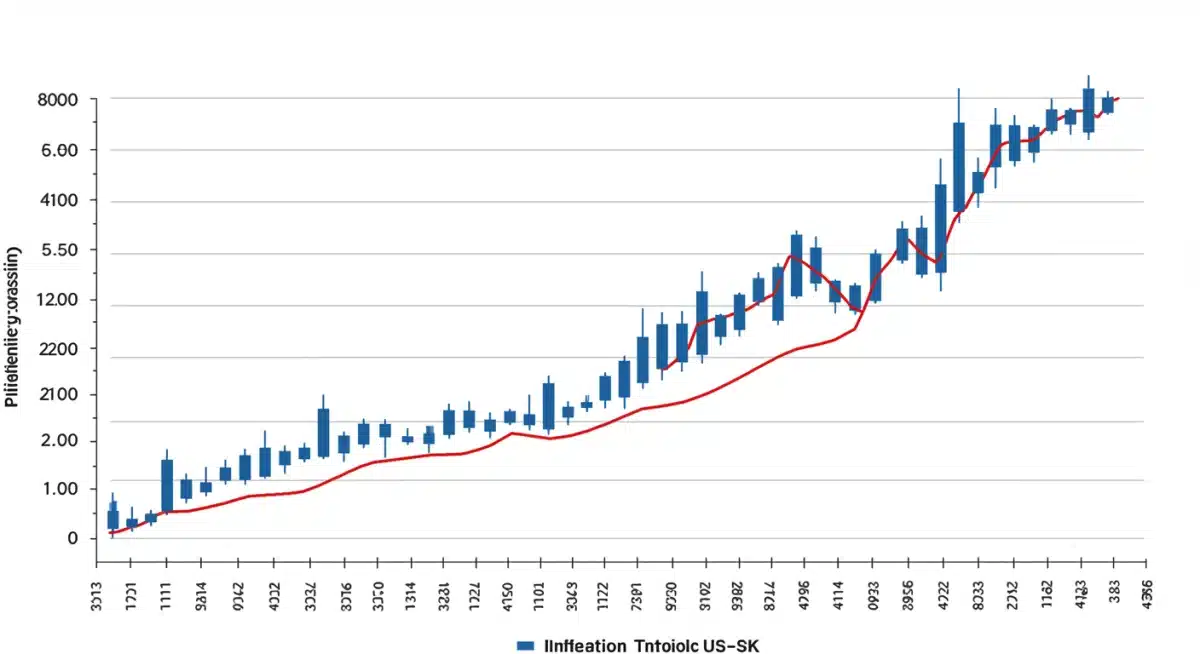

The current 5.5% inflation rate in the US demands that long-term savers re-evaluate and adjust their investment strategies to safeguard and enhance their purchasing power against eroding financial value.

As the United States grapples with a persistent 5.5% inflation rate, long-term savers face a critical challenge: how to protect and grow their wealth when the purchasing power of their money is steadily diminishing. This environment necessitates a careful re-evaluation of traditional investment approaches and a proactive adoption of strategies designed to combat inflationary pressures. Understanding how the current 5.5% inflation rate affects investment strategies for long-term savers in the US is paramount for financial resilience and future prosperity.

Understanding the Erosion of Purchasing Power

Inflation, at its core, represents the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. A 5.5% inflation rate means that what $100 could buy a year ago now costs $105.50. For long-term savers, this seemingly small percentage can have a profound cumulative effect over decades, significantly eroding the real value of their accumulated wealth.

The impact is particularly acute for those holding cash or investments that yield returns below the inflation rate. Traditional savings accounts and some bonds, which historically offered modest but stable returns, often fall victim to this phenomenon. Savers must recognize that simply preserving the nominal value of their capital is insufficient; the goal must shift to preserving and growing its real, inflation-adjusted value.

The Silent Tax on Savings

- Reduced Future Purchasing Power: Every dollar saved today will buy less in the future if inflation outpaces investment returns.

- Negative Real Returns: If an investment yields 3% but inflation is 5.5%, the real return is a negative 2.5%, meaning the saver is losing money in real terms.

- Impact on Fixed Income: Retirees relying on fixed pensions or annuities find their income’s buying power shrinking rapidly.

This erosion demands a proactive stance. Simply setting money aside is no longer a viable strategy for long-term financial security. Instead, investments must be chosen with a clear understanding of their potential to outperform inflation, thereby maintaining or increasing the saver’s real wealth. The psychological impact of seeing one’s savings diminish in value, even if the number in the bank account remains the same, can also be significant, underscoring the need for effective strategies.

In conclusion, a 5.5% inflation rate acts as a silent tax on savings, making it imperative for long-term investors to actively seek out assets that can offer returns greater than this rate. Understanding this fundamental concept is the first step toward building a resilient investment portfolio.

Re-evaluating Traditional Asset Classes in an Inflationary Environment

The conventional wisdom surrounding asset allocation often needs recalibration when inflation accelerates. What worked in periods of low, stable inflation may prove detrimental when prices are rising rapidly. Investors must critically assess how different asset classes perform under the pressure of a 5.5% inflation rate, moving beyond nominal returns to focus on real returns.

Cash, while offering liquidity, is perhaps the most vulnerable asset during high inflation. Its purchasing power declines directly with the inflation rate, making it a poor choice for long-term savings beyond emergency funds. Similarly, many fixed-income investments, especially those with longer maturities, suffer as rising interest rates (often a response to inflation) decrease their market value.

Bonds and Fixed Income

- Nominal vs. Real Yields: A bond yielding 4% offers a negative real yield of -1.5% with 5.5% inflation.

- Interest Rate Risk: As central banks raise rates to combat inflation, existing bonds with lower coupon rates become less attractive, leading to price declines.

- Inflation-Protected Securities (TIPS): These government bonds adjust their principal value with inflation, offering a direct hedge, but their real yield can still be modest.

Equities, on the other hand, can offer a more complex picture. While some companies may struggle with rising input costs, others with strong pricing power can pass these costs onto consumers, potentially growing their revenues and profits. Real estate, often viewed as an inflation hedge, tends to appreciate with rising prices and can generate rental income that also adjusts upwards over time. Commodities, such as gold and oil, often see their prices rise during inflationary periods, serving as a direct hedge.

Therefore, long-term savers should reconsider their portfolio’s exposure to purely nominal assets and increase their allocation to assets that have historically demonstrated an ability to either directly or indirectly benefit from, or at least keep pace with, inflation. This re-evaluation is not about abandoning traditional asset classes entirely but adjusting their proportion and type within a diversified portfolio.

Diversification and Inflation Hedges for Long-Term Growth

In an environment of 5.5% inflation, diversification becomes even more critical, not just across different asset classes, but specifically into those that historically act as effective inflation hedges. The goal is to build a portfolio that can withstand the erosion of purchasing power and continue to grow in real terms over the long run. Simply holding a broad market index might not be enough if its components are disproportionately vulnerable to inflationary pressures.

Real assets are often considered excellent inflation hedges. These include real estate, commodities, and infrastructure. Real estate, whether direct ownership or through Real Estate Investment Trusts (REITs), benefits from rising property values and rental income that can be adjusted upwards. Commodities, like precious metals (gold, silver) and energy (oil, natural gas), tend to perform well when inflation is high because their prices are often a direct component of rising costs.

Key Inflation-Hedging Assets

- Real Estate: Provides appreciation and rental income that can grow with inflation.

- Commodities: Direct beneficiaries of rising prices for raw materials.

- Treasury Inflation-Protected Securities (TIPS): Government bonds whose principal adjusts with the Consumer Price Index (CPI).

- Dividend Growth Stocks: Companies with strong balance sheets and pricing power that can consistently increase dividends.

Furthermore, certain sectors within the equity market may be more resilient. Companies with strong pricing power, low capital intensity, and essential products or services can often pass on increased costs to consumers, maintaining profit margins. Value stocks, which are often undervalued by the market, can also present opportunities, especially if their underlying assets are tangible and inflation-resistant. International diversification can also play a role, as inflation rates and economic conditions vary globally.

Ultimately, a well-diversified portfolio for long-term savers facing 5.5% inflation will likely include a mix of these assets, carefully balanced to mitigate risk while maximizing the potential for real returns. Regular rebalancing and a vigilant eye on economic indicators are essential components of this strategy, ensuring the portfolio remains aligned with prevailing economic conditions.

The Role of Equities and Sector-Specific Opportunities

While inflation can be a headwind for some businesses, the equity market still offers significant opportunities for long-term savers. Not all stocks react uniformly to inflationary pressures; some sectors and individual companies are inherently better positioned to thrive or at least maintain their value. The key lies in identifying these resilient players and integrating them into an investment strategy designed to counteract a 5.5% inflation rate.

Companies with strong pricing power are particularly attractive. These are businesses that can raise the prices of their goods or services without significantly impacting demand. Examples often include established brands with loyal customer bases, companies with proprietary technology or patents, or those operating in industries with high barriers to entry. Such firms can effectively pass on increased input costs to consumers, thereby protecting their profit margins.

Identifying Resilient Equity Sectors

- Consumer Staples: Companies producing essential goods often maintain demand regardless of price increases.

- Energy: Benefits directly from rising commodity prices, especially oil and gas.

- Utilities: Often have regulated pricing structures that allow for cost recovery, though sometimes with a lag.

- Financials: Can benefit from rising interest rates, which often accompany inflation, by increasing lending margins.

Furthermore, businesses with low capital expenditure requirements and strong free cash flow generation tend to be more robust during inflationary periods. They are less exposed to rising costs of capital goods and can reinvest profits or return capital to shareholders. Dividend growth stocks, particularly those from companies with a long history of increasing their payouts, can also serve as an inflation hedge, as growing dividends can help offset the erosion of purchasing power.

Investing in growth stocks during inflation requires a more nuanced approach. While high-growth companies often trade on future earnings, which are discounted more aggressively when interest rates rise, those with truly disruptive technologies or expanding markets may still outperform. The focus should be on companies with sustainable competitive advantages and the ability to innovate and adapt.

In essence, long-term savers should not abandon equities but rather become more selective. A strategic allocation to companies that demonstrate pricing power, operate in resilient sectors, and possess strong financial health can provide a crucial component of an inflation-resistant portfolio, helping to ensure that investment returns outpace the 5.5% inflation rate.

Leveraging Real Assets: Real Estate and Commodities

Real assets, by their very nature, tend to offer a tangible hedge against inflation, making them especially compelling for long-term savers navigating a 5.5% inflation environment. Unlike financial assets whose value can be purely monetary, real assets possess intrinsic value tied to physical goods and properties, which often appreciate as the cost of living and production rises.

Real estate is a prime example. Whether investing directly in physical properties or indirectly through Real Estate Investment Trusts (REITs), real estate provides dual benefits during inflation. Property values typically increase with general price levels, preserving capital. Additionally, rental income can be adjusted upwards, providing a growing stream of income that helps to offset rising costs. This makes real estate a robust component of an inflation-hedged portfolio.

Types of Real Asset Investments

- Residential Real Estate: Direct ownership or REITs focused on housing.

- Commercial Real Estate: Office buildings, retail spaces, industrial properties, often through REITs.

- Precious Metals: Gold and silver have historically been viewed as stores of value during economic uncertainty and inflation.

- Industrial Commodities: Oil, natural gas, copper, and agricultural products, which are fundamental to production and consumption.

Commodities, another critical category of real assets, often see their prices surge during inflationary periods. This is because inflation frequently stems from increased demand or supply chain disruptions, both of which drive up the cost of raw materials. Gold, in particular, has a long-standing reputation as an inflation hedge and a safe haven asset. Other commodities like oil, natural gas, and agricultural products are essential inputs for the economy, and their rising prices contribute directly to inflation, making them effective hedges.

Investing in commodities can be done through various avenues, including direct ownership (though often impractical), commodity-focused exchange-traded funds (ETFs), or futures contracts. Each method carries its own risk profile and liquidity considerations. For long-term savers, ETFs or mutual funds that track broad commodity indices or specific sectors might offer a more diversified and accessible approach.

Incorporating real assets into a long-term investment strategy is not without its complexities. Real estate can be illiquid, and commodity markets can be volatile. However, judicious allocation to these assets can provide a powerful counterbalance to the erosive effects of a 5.5% inflation rate, helping to preserve and enhance the real value of a saver’s portfolio over time.

Protecting Retirement Savings and Long-Term Goals

For long-term savers, particularly those planning for retirement, the challenge posed by a 5.5% inflation rate is particularly acute. Retirement savings, often accumulated over decades, are highly vulnerable to the compounding effect of inflation if not adequately protected. Ensuring that these funds retain their purchasing power, and ideally grow beyond it, is paramount for a comfortable future.

The first step involves a realistic assessment of future expenses. Inflation means that the cost of living in retirement will be significantly higher than it is today. Retirement calculators and financial plans must incorporate a higher inflation assumption to provide an accurate picture of the capital needed. This often means increasing savings rates or adjusting investment strategies to target higher real returns.

Strategies for Retirement Accounts

- Maximize Contributions: Contribute as much as possible to tax-advantaged accounts like 401(k)s and IRAs, which allow for tax-deferred growth.

- Strategic Asset Allocation: Ensure retirement portfolios are heavily weighted towards inflation-hedging assets such as equities, real estate, and TIPS.

- Consider Annuities with Inflation Riders: Some annuities offer options to increase payouts over time, providing a hedge against rising costs.

Beyond asset allocation, financial planning strategies play a crucial role. For those nearing retirement, converting a portion of their portfolio into inflation-protected securities can provide a guaranteed real income stream. For younger savers, a more aggressive allocation to growth-oriented, inflation-resilient equities might be appropriate, leveraging the power of compounding over a longer time horizon.

It is also vital to regularly review and rebalance retirement portfolios. Economic conditions change, and a strategy that was optimal a few years ago might not be today. A financial advisor can provide personalized guidance, helping to structure a portfolio that aligns with individual risk tolerance, time horizon, and specific retirement goals, all while accounting for the persistent threat of a 5.5% inflation rate.

In summary, protecting retirement savings requires a multi-faceted approach that combines strategic asset allocation, realistic financial planning, and ongoing vigilance. Ignoring the impact of inflation on long-term goals can have severe consequences, making proactive measures absolutely essential for securing a financially stable retirement.

The Importance of Professional Guidance and Regular Review

Navigating an investment landscape marked by a 5.5% inflation rate is complex, and the stakes are high for long-term savers. While the principles of diversification and inflation hedging are clear, their practical application requires careful consideration, tailored to individual circumstances. This is where professional financial guidance becomes invaluable, offering expertise and perspective that can optimize investment strategies.

A qualified financial advisor can help assess an individual’s risk tolerance, time horizon, and specific financial goals, then construct a portfolio designed to meet those objectives while mitigating the effects of inflation. They possess in-depth knowledge of various investment vehicles, tax implications, and market dynamics, enabling them to recommend appropriate allocations to equities, real estate, commodities, and other inflation-hedging assets.

Benefits of Financial Advisory

- Personalized Strategy: Tailored investment plans that align with individual financial situations and goals.

- Market Insight: Access to expert analysis and forecasting regarding inflation trends and asset performance.

- Risk Management: Guidance on balancing inflation protection with overall portfolio risk.

- Behavioral Coaching: Helping investors avoid emotional decisions during volatile market periods.

Beyond initial planning, the ongoing review is equally critical. Economic conditions are dynamic, and inflation rates can fluctuate. Regular portfolio reviews ensure that the investment strategy remains aligned with current market realities and personal circumstances. This involves rebalancing assets, adjusting allocations, and identifying new opportunities or threats as they emerge. An advisor can provide the discipline and objective perspective needed to make timely adjustments.

Furthermore, professional guidance can extend to tax planning, estate planning, and other aspects of wealth management that are impacted by inflation. For instance, understanding how inflation affects capital gains taxes or the real value of bequests is crucial for comprehensive financial health. The cost of advice is often offset by the value gained through optimized returns and avoided pitfalls.

In conclusion, while self-directed investing is an option, the complexities introduced by a significant inflation rate make professional guidance a wise investment for long-term savers. Coupled with diligent, regular reviews, this approach can significantly enhance the probability of achieving financial goals, even in challenging economic environments.

| Key Point | Brief Description |

|---|---|

| Inflation’s Impact | A 5.5% inflation rate significantly erodes the purchasing power of savings, necessitating proactive investment strategies. |

| Asset Re-evaluation | Traditional low-yield assets are vulnerable; focus shifts to real returns over nominal gains. |

| Inflation Hedges | Diversify into real estate, commodities, and equities with pricing power to combat wealth erosion. |

| Professional Guidance | Seek expert advice for personalized strategies and regular portfolio reviews to adapt to changing economic conditions. |

Frequently Asked Questions About Inflation and Investments

A 5.5% inflation rate means your money loses 5.5% of its purchasing power annually. Over the long term, this compounding effect can significantly reduce the real value of your savings, making it harder to achieve future financial goals without strategic investment adjustments.

Investments that historically perform well during high inflation include real estate, commodities (like gold and oil), Treasury Inflation-Protected Securities (TIPS), and stocks of companies with strong pricing power and stable cash flows. Diversification across these assets is often recommended.

Yes, it’s crucial to review and potentially adjust your retirement strategy. Ensure your portfolio includes assets that can outperform inflation. Consider increasing contributions, diversifying into inflation-hedging assets, and incorporating a higher inflation assumption into your retirement planning.

Fixed-income investments generally perform poorly. If bonds yield less than 5.5%, your real return is negative, meaning your capital’s purchasing power declines. Rising interest rates, often a response to inflation, also decrease the market value of existing bonds, leading to capital losses.

While not strictly necessary for everyone, professional financial advice can be highly beneficial. An advisor can provide personalized strategies, help identify suitable inflation hedges, manage risk, and ensure your portfolio remains aligned with your long-term goals amidst complex economic conditions.

Conclusion

The current 5.5% inflation rate in the US presents a significant challenge for long-term savers, demanding a strategic and informed approach to investment. Simply maintaining nominal capital is insufficient; the focus must shift to preserving and growing real purchasing power. By understanding the erosive effects of inflation, re-evaluating traditional asset allocations, and actively incorporating inflation-hedging assets like real estate, commodities, and resilient equities, savers can build more robust and future-proof portfolios. Furthermore, regular portfolio reviews and professional financial guidance are invaluable tools in navigating this complex economic landscape, ensuring that long-term financial goals remain achievable despite persistent inflationary pressures. Proactive adaptation is not merely advisable, but essential for financial resilience.