Real Estate Market 2025: 3% Price Correction & Homeowner Impact

The real estate market in 2025 faces a potential 3% price correction, which could significantly impact homeowners through shifts in equity, affordability, and refinancing options, necessitating strategic financial planning.

The prospect of a significant shift in the housing landscape looms as we approach 2025. Many analysts are now forecasting a potential real estate market 2025: analyzing a potential 3% price correction and its impact on homeowners, a development that could reshape financial strategies for millions. This isn’t just about numbers on a spreadsheet; it’s about the tangible effects on families, investments, and the broader economy.

Understanding the 2025 Real Estate Forecast

As we gaze into the crystal ball of the real estate market for 2025, a consistent theme emerges: a moderate price correction. This isn’t a crash, but rather a rebalancing act after several years of unprecedented growth. Several macroeconomic factors are converging to create this anticipated shift, influencing both buyer behavior and seller expectations across the United States.

The housing market’s recent trajectory has been a roller coaster, fueled by low interest rates and a pandemic-induced surge in demand for more spacious living. However, the economic landscape is evolving, with inflation, interest rate adjustments, and a gradual return to pre-pandemic norms playing significant roles. Understanding these underlying forces is crucial for both current homeowners and prospective buyers.

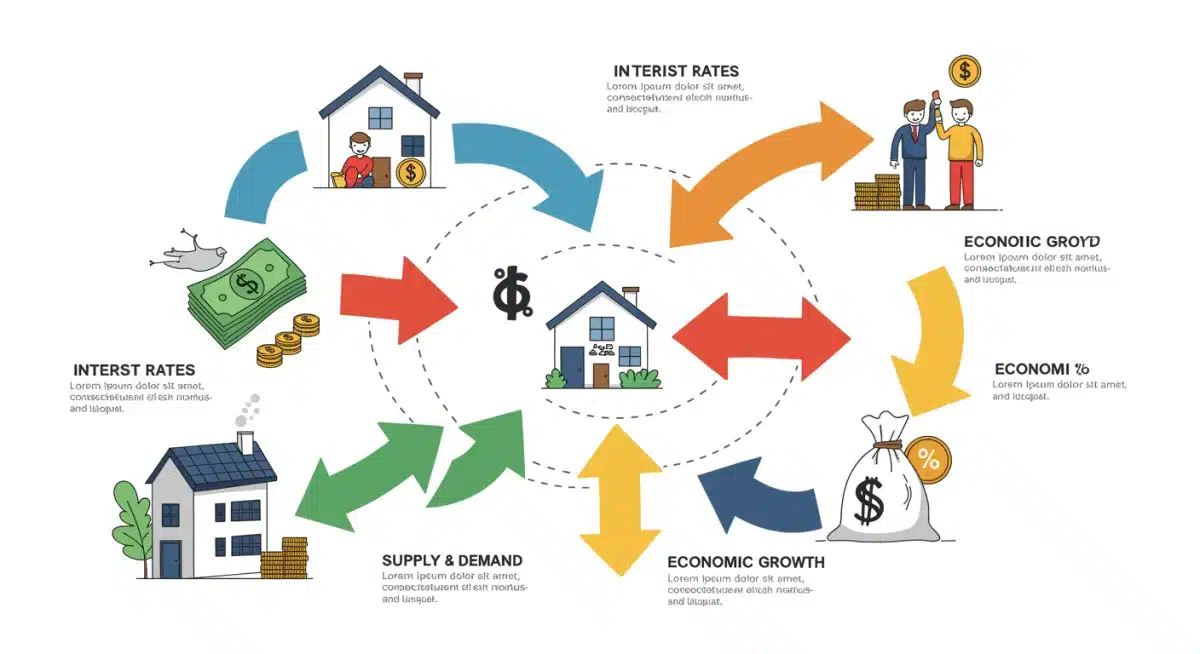

Key Economic Indicators Driving the Correction

Several economic indicators are signaling a potential moderation in housing prices. These include inflation trends, the Federal Reserve’s monetary policy, and employment figures. Each plays a role in shaping the demand and supply dynamics of the market.

- Interest Rate Hikes: Sustained increases in mortgage rates have undeniably cooled buyer enthusiasm, making homeownership less affordable for a segment of the population.

- Inflationary Pressures: While inflation has shown signs of easing, its lingering effects on purchasing power continue to influence housing affordability.

- Supply and Demand Rebalancing: New construction is slowly catching up, and a more balanced inventory could ease competitive bidding wars.

In conclusion, the 2025 real estate forecast points towards a period of adjustment. This correction, while potentially unsettling for some, can also present opportunities for others, creating a more sustainable market environment in the long run.

Analyzing the 3% Price Correction: What Does it Mean?

A projected 3% price correction in the real estate market might sound modest, but its implications can be far-reaching, especially for homeowners who purchased at or near the peak of the market. This percentage, while seemingly small, represents a significant shift in home equity and overall market valuation. It’s important to dissect what this figure truly entails for different segments of the homeowner population.

For context, a 3% drop nationally doesn’t mean every home will decrease by exactly 3%. Local markets will experience varying degrees of correction, with some areas seeing larger dips and others remaining relatively stable. Understanding these nuances is key to assessing personal impact.

Impact on Home Equity

The most immediate effect of a price correction is on home equity. For recent buyers, particularly those with smaller down payments, a 3% correction could reduce their equity, potentially putting them closer to an ‘underwater’ scenario where their mortgage balance exceeds their home’s value. This is a primary concern for many.

- Recent Buyers: Those who bought in the last 1-2 years with minimal equity might feel the pinch most acutely.

- Long-Term Homeowners: Individuals who have owned their homes for many years and accumulated substantial equity are less likely to be severely impacted, though their overall net worth might see a slight reduction.

- Refinancing Challenges: Reduced equity can make it harder to refinance or access home equity lines of credit (HELOCs).

Ultimately, a 3% correction signifies a market recalibration. It’s a move towards more sustainable pricing, but it requires homeowners to be acutely aware of their equity position and prepared for potential adjustments in their financial planning.

Mortgage Implications for Homeowners

The anticipated 3% real estate price correction in 2025 will undoubtedly have significant mortgage implications for homeowners. This extends beyond just the value of one’s home, touching upon refinancing opportunities, mortgage portability, and the overall cost of homeownership. Understanding these dynamics is crucial for making informed financial decisions in a shifting market.

Rising interest rates, a key driver of the expected correction, directly influence mortgage affordability and the attractiveness of refinancing existing loans. Homeowners with adjustable-rate mortgages (ARMs) may experience changes sooner, while those with fixed-rate mortgages might feel the impact indirectly through reduced equity or changes in their ability to leverage their home’s value.

Refinancing and Equity Access

A dip in home values can complicate refinancing efforts. Lenders assess loan-to-value (LTV) ratios, and a lower home appraisal can reduce the amount homeowners can borrow or even disqualify them from certain refinancing products. This is especially pertinent for those looking to tap into their home equity for other investments or debt consolidation.

- Higher LTV Ratios: A 3% price drop means a higher LTV, potentially limiting access to cash-out refinances or attractive rates.

- HELOC Challenges: Home Equity Lines of Credit might become harder to secure or have lower borrowing limits if home values decline.

- Interest Rate Lock-in: Homeowners with low fixed rates from previous years might find it less appealing to refinance, even if rates slightly decrease, due to reduced equity.

In essence, the mortgage landscape will become more challenging for some homeowners. Proactive engagement with lenders and a thorough understanding of one’s current mortgage terms will be vital in navigating these changes effectively.

Regional Variations and Local Market Dynamics

While a national 3% real estate price correction is a useful benchmark, the reality on the ground will be far more nuanced. The United States real estate market is a mosaic of local economies, each with its own unique drivers of supply and demand. Therefore, the impact of a correction will vary significantly from one region to another, and even from one neighborhood to the next.

Factors such as local job growth, population shifts, housing inventory levels, and specific zoning regulations play crucial roles in how a national trend translates into local market performance. A city experiencing robust economic expansion and population influx might see minimal correction, or even continued appreciation, while areas with declining industries or oversupply could experience more pronounced price adjustments.

Geographic Hotspots and Coldspots

Certain regions that saw explosive growth during the pandemic, often driven by remote work trends, might be more susceptible to corrections as migration patterns normalize. Conversely, traditionally stable markets with consistent demand and limited new construction may be more resilient. It’s not a one-size-fits-all scenario.

- Sun Belt Boomtowns: Areas like parts of Florida, Texas, and Arizona that experienced rapid appreciation may see a more noticeable cooling.

- Coastal Metros: Established, high-cost markets like New York and California might see minor corrections or simply slower growth, given their inherent demand.

- Midwest Stability: Many Midwestern cities with more affordable housing and steady economies could remain relatively stable.

Consequently, homeowners must look beyond national headlines and delve into the specifics of their local market. Consulting with local real estate experts and monitoring regional economic indicators will provide a clearer picture of their property’s potential trajectory.

Strategic Advice for Homeowners in 2025

Navigating a real estate market with a potential 3% price correction requires a proactive and strategic approach from homeowners. While a moderate correction is not cause for panic, it does necessitate careful planning and an understanding of how to best protect and leverage one’s investment. The right strategies can help mitigate risks and even uncover opportunities.

Homeowners should assess their current financial position, understand their home’s equity, and consider their long-term housing goals. This period of adjustment can be an opportune time to make informed decisions that align with personal financial objectives, rather than reacting impulsively to market shifts.

Key Strategies for Stability and Growth

Several actions can help homeowners prepare for and respond to a market correction. These strategies focus on financial resilience, property enhancement, and informed decision-making.

- Review Your Equity: Regularly check your home’s estimated value and your remaining mortgage balance to understand your current equity position.

- Strengthen Financial Reserves: Build an emergency fund to cover unexpected costs or potential job market fluctuations.

- Consider Home Improvements Wisely: Focus on renovations that offer a strong return on investment, such as kitchen or bathroom remodels, rather than purely aesthetic changes.

- Monitor Local Market Trends: Stay informed about property values, inventory, and economic developments in your specific area.

By adopting these strategies, homeowners can better position themselves to withstand a market correction and ensure the long-term health of their real estate investment, transforming potential challenges into manageable situations.

Long-Term Outlook Beyond the Correction

While the immediate focus is on the potential 3% real estate price correction in 2025, it’s equally important for homeowners and prospective buyers to consider the long-term outlook of the housing market. Real estate has historically proven to be a resilient asset, appreciating over extended periods despite short-term fluctuations. Understanding this broader perspective can help alleviate anxieties and inform future planning.

Market corrections are a natural part of economic cycles. They often serve to cool down overheated markets, creating a more sustainable and balanced environment for future growth. The factors that drive long-term appreciation, such as population growth, economic development, and inflation, generally remain intact, even during periods of temporary adjustment.

Factors Supporting Long-Term Appreciation

Several fundamental drivers suggest that the housing market will continue its upward trajectory over the long haul, even after a 2025 correction. These underlying forces provide a foundation for sustained value growth.

- Population Growth: A continually growing population in the U.S. ensures ongoing demand for housing.

- Limited Land Supply: In many desirable areas, developable land is finite, contributing to long-term value.

- Inflation Hedge: Real estate often acts as a hedge against inflation, as property values and rents tend to rise with the cost of living.

- Economic Development: Strong local economies, driven by innovation and job creation, continually support housing demand.

Therefore, while 2025 might present a temporary dip, the long-term prognosis for real estate ownership remains positive. Homeowners who maintain a long-term perspective and make sound financial decisions are likely to see their investments recover and continue to grow over time, reinforcing the enduring value of property ownership.

| Key Aspect | Brief Description |

|---|---|

| 3% Price Correction | Anticipated moderate decline in national home values for 2025, not a crash. |

| Homeowner Impact | Affects equity, refinancing ability, and overall financial planning for recent buyers. |

| Mortgage Implications | Higher LTVs and potential challenges for cash-out refinances or HELOCs. |

| Strategic Response | Review equity, build reserves, make wise home improvements, and monitor local trends. |

Frequently Asked Questions About the 2025 Housing Market

A 3% correction means that, on average, home values nationally are expected to decline by that percentage. For your specific home, the impact could be slightly more or less, depending on your local market’s unique dynamics and demand. It’s a general trend, not a universal fixed decrease.

If you bought recently with a small down payment, a 3% correction could reduce your equity, potentially bringing you closer to having less equity than desired. However, for most homeowners, this is a moderate adjustment, and long-term appreciation often mitigates short-term dips in value.

A 3% correction could slightly improve affordability by lowering purchase prices. However, interest rates remain a significant factor. If interest rates stay high, the overall monthly mortgage payment might not decrease substantially, even with a slight price drop.

Homeowners should review their home equity, build a robust emergency fund, and consider making value-adding home improvements. Staying informed about local market trends and consulting with financial advisors can also provide tailored guidance during this period of adjustment.

No, a 3% correction is generally considered a moderate adjustment or rebalancing, not a crash. Market crashes typically involve much larger and more rapid declines. This anticipated correction is more indicative of a return to more sustainable market conditions after a period of rapid growth.

Conclusion

The anticipation of a 3% real estate price correction in 2025 presents both challenges and opportunities for homeowners across the United States. While a modest dip in home values can impact equity and refinancing capabilities, it is crucial to view this as a market rebalancing rather than a catastrophic event. By understanding the underlying economic drivers, assessing individual financial positions, and implementing strategic planning, homeowners can effectively navigate these changes. The long-term resilience of the real estate market suggests that while short-term adjustments are inevitable, property ownership remains a valuable and appreciating asset over time, reinforcing the importance of informed decision-making and a patient perspective.